PayPal fees are too high and not everyone knows how the PayPal currency conversion works actually. PayPal’s exchange rates or currency conversion rates are too poor and it’s due to high fees/charges behind.

In this informative post, I’m going to tell you how does PalPal deduct its fees once you receive a payment. Then why is currency conversion is lower as well as why do you get less money in your bank account than expected? This post is written while having my experience to work with overseas clients and I stay in India. But the explanation here will help you to understand the whole fees, charge, and conversion processes.

PayPal Fees are too High

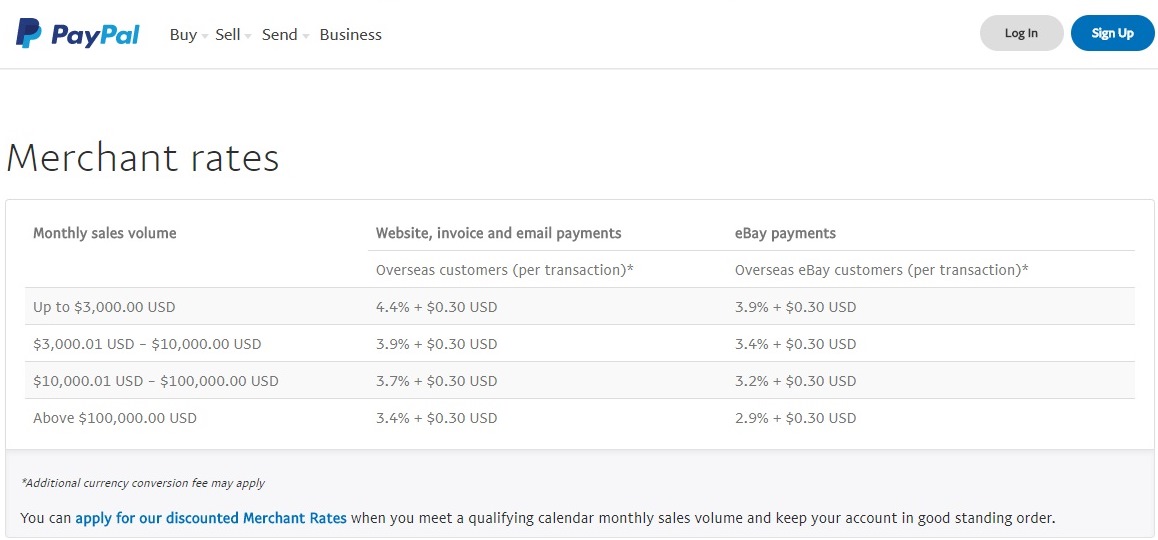

As compared to other payment gateways to receive money from clients in the foreign countries, PayPal charges 1 to 3% extra cost as fees. As you can see in the screenshot attached at beginning of this article, PayPal charges 4.4% + $0.30 USD as fees for a monthly sales volume up to $3,000.00 USD for a merchant residing in India.

It means if you receive $500 USD payment, PayPal fees would be $22.30 USD.

Update 10/11/2017: If you’re in India, PayPal has started charging 18% over its fees as GST (Goods and Service Tax) since November 1, 2017. Other countries might have their own tax system.

If you’re registered under GST and have GSTN, you can add it within PayPal dashboard. At end of every month, PayPal will generate an invoice, through it you can reclaim for ITC (Input Tax Credit), the 18% tax over PayPal fees.

PayPal dashboard URL to add GSTN {Profile -> Business name -> Business information (Tab) -> Business information -> Update}

And finally, the net amount in your account would be $473.686 USD.

PayPal Fees = ($500 * 4.4/100) + $0.30 = $22 + .30 = $22.30 USD

18% GST = $22.30 * 18 /100 = $4.014 USD

Net Amount = $500 – $22.30 – $4.014 = $473.686 USD

Now the net amount is ready to get converted into your local currency for withdrawl. Keep reading the follwoing to know how it works.

How Currency Conversion Works

PayPal will now charge 2.5% fees above market exchange rate to convert the US dollars to INR or UK pound. So the actual currency conversion rate would be lower. You can google, visit xe.com, or ask your bank for today’s exchange rate and reduce it by 2.5%.

Suppose today’s currency conversion rate for USD to INR is 65.00, then PayPal will use INR 63.375 to convert your net USD amount to INR.

PayPal Exchange Rate = 65 – (65 * 2.5/100) = 65 – 1.625 = 63.375 INR

Net Amount in INR = 473.686 * 63.375 = ~30,019.85 INR

That’s it. After the too high PayPal fees, you will also lose anywhere between 2.5 – 3% in exchange rate since PayPal’s currency conversion rate is always low or poor due to this 2.5% conversion fees. sadly currency conversion by PayPal works in this way.

Setup a branded HTML email template in MS – Outlook.

Full tutorial from start to finish.

As per RBI regulation, PayPal can’t hold your money so at end of the day, it will transfer the money (INR 30,019.85 herein example) to your bank account and it usually takes 2-3 business days to reach.

Further your bank might also charge some commission or fee depending upon your account type and as per bank’s policy.

Your Thought About High PayPal Fees?

You can easily check PayPal fees, net amount, actual conversion rate and other information related to the transaction on the summary page or PayPal dashboard.

So in comparison to Payoneer or TransferWise, PayPal fees are too high and the poor exchange rate is such an additional pain. Would you like to share your experience related to PayPal or other alternatives? Comment below.

Yes i agreed .me too suffered.